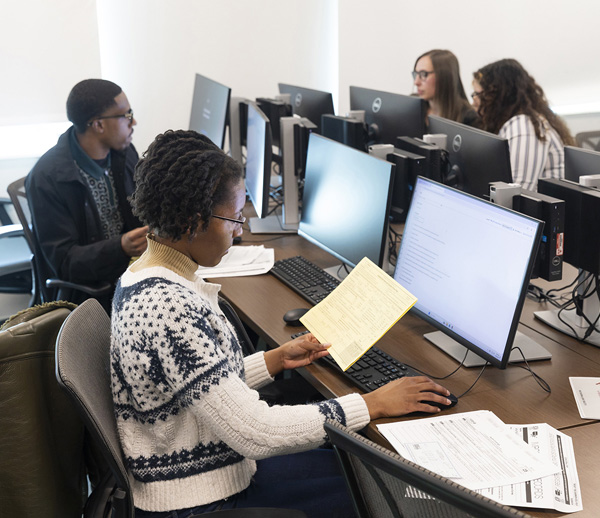

PHOTO CAPTION: Faculty and students from Valdosta State University’s School of Accountancy and Mu Zeta chapter of Beta Alpha Psi are ready to support underserved populations across South Georgia by providing federal and state tax return preparation and electronic filing services. To qualify for this free community service, taxpayers must have a household income of less than $68,675 for the year.

VALDOSTA — Faculty and students from VSU’s School of Accountancy and Mu Zeta chapter of Beta Alpha Psi are providing tax services.

Release:

VALDOSTA — Faculty and students from Valdosta State University’s School of Accountancy and Mu Zeta chapter of Beta Alpha Psi are ready to support underserved populations across South Georgia by providing federal and state tax return preparation and electronic filing services. To qualify for this free community service, taxpayers must have a household income of less than $68,675 for the year.

This is VSU’s seventh year participating with the Internal Revenue Service’s Volunteer Income Tax Assistance (VITA) Program. The student and faculty volunteers began meeting with clients on Feb. 3.

Sergio Perez-Sifuentes, president of VSU’s student chapter of Beta Alpha Psi, said 13 accounting and two finance majors are volunteering their time to work with the IRS VITA Program at VSU this year. All student volunteers have passed advanced tax certification training that meets or exceeds IRS standards, including maintaining the privacy and confidentiality of all taxpayer information.

Volunteer tax preparers are available to meet with clients from 4 p.m. to 7 p.m. on Tuesdays and 9 a.m. to 3 p.m. on Fridays in the first-floor lobby of VSU’s Health Sciences and Business Administration Building, located at the intersection of Patterson Street and Pendleton Drive across from South Georgia Medical Center. Area residents who wish to utilize this service should have all their tax-related documents with them when they arrive on campus.

Appointments are not necessary.

All tax returns go through a quality review check prior to filing, and they are not filed until the taxpayer gives final approval.

The VSU volunteers are supervised by Dr. Candace Witherspoon, certified fraud examiner and professor of accounting, and Dr. Raymond Elson, certified public accountant, professor of accounting, interim head of the School of Accountancy, and associate dean of the Harley Langdale Jr. College of Business Administration. (Elson is also president of Beta Alpha Psi for the United States.)

Perez-Sifuentes said Beta Alpha Psi is proud of its tradition of being a trusted and reliable source of tax preparation services for the community. This is his second year working with the IRS VITA Program, and he described the annual initiative as a prime example of service learning and community engagement in action.

“This program is important because it provides free, reliable tax assistance to individuals and families who may not otherwise have access to professional services,” he said. “At the same time, it gives students hands-on experience working with real clients, helping us build confidence, professionalism, and practical skills before entering the workforce. It is truly a win-win for both the community and the university.”

Sifuentes earned a Bachelor of Business Administration in Finance and a Bachelor of Business Administration in Applied Economics from VSU in 2025. He is currently pursuing a Master of Business Administration.

Beta Alpha Psi: The International Honor Organization for Financial Information Students and Professionals encourages the study and practice of accountancy, finance, business analytics, or digital technology; provides opportunities for service, professional development, and interaction among members and financial professionals; and fosters lifelong ethical, social, and public responsibilities.

VSU’s School of Accountancy holds specialized accreditation from the Association to Advance Collegiate Schools of Business (AACSB). About two percent of schools hold this premier accreditation.

VSU’s College of Business Administration also holds extended AACSB accreditation for its Bachelor of Business Administration and Master of Business Administration programs, a designation held by about five percent of the world’s business schools.

AACSB accreditation helps to ensure that students are learning material that is most relevant to their field of study, preparing them to be effective leaders and lifelong learners capable of meeting the needs of a changing global society upon graduation.

Please contact Sergio Perez-Sifuentes at sperezsifuentes@valdosta.edu for more information. Tax preparers speak English, Spanish, Vietnamese, Ukranian, and Russian.

On the Web:

https://www.valdosta.edu/colleges/business

https://www.irs.gov/individuals/irs-vita-grant-program

What do taxpayers need to participate in the IRS VITA Program at VSU?

• Social Security and/or ITIN numbers for taxpayer, spouse, and dependents.

• Photo ID for taxpayer and spouse.

• All tax statements and additional information. Examples include W2, 1099, 1099-R, 1099-DIV, Social Security benefits statement, other income sources, tuition statement (1098-T), Form 1095-A/B/C.

• Copy of 2024 tax return, if available.

• Bank account number and routing number for direct deposit of refund.